Trading 212 Invest is an impressive platform catering to investors seeking a user-friendly and accessible way to navigate the financial markets. Trading 212 is a European broker that offers commission-free trading on numerous stock exchanges. Many of you have asked for my opinion on this broker. The platform offers a wide range of capabilities and features that benefit both novice and experienced investors.

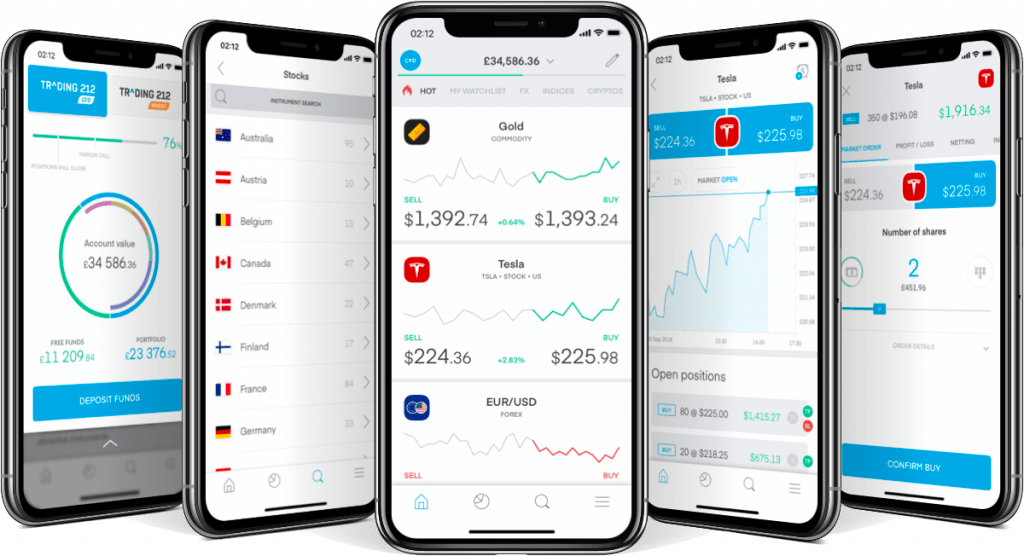

User-Friendly Interface

One of the standout features of Trading 212 Invest is its intuitive and clear interface. Even investors with limited experience will quickly become familiar with the navigation. It’s easy to locate various assets and conduct analyses.

Trading 212 offers two main types of accounts

- Investing: For investing in stocks and ETFs.

- CFD: For investing in Contracts for Difference (CFD)

As a long-term investor myself, I will focus solely on Trading 212 Inves in this review.

Comprehensive Range of Investment Opportunities

Trading 212 Invest offers a diverse range of investment options, spanning from stocks to ETFs and mutual funds. This allows investors to diversify their portfolios and pursue their investment objectives.

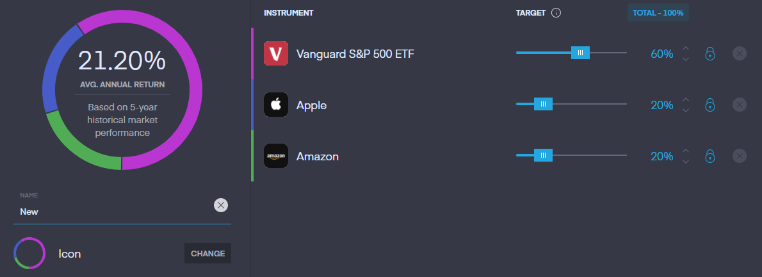

Auto Invest and Pie Rebalancing

Lets get talk about my favorite feature Trading 212 offers called Auto Invest, which allows you to set up automated investments according to your chosen criteria. This can be particularly useful for long-term investors who want to implement a systematic approach to their portfolio. You can select specific stocks or ETFs, set the investment amount, and determine the frequency of contributions.

Furthermore, Trading 212’s Pie feature allows you to create a diversified portfolio by allocating a percentage of your investment to different assets or sectors. This helps spread risk and maintain a balanced portfolio. The platform also offers automated rebalancing of your Pie, ensuring that your allocations stay in line with your chosen strategy over time.

No Commissions

Let’s take a look at Trading 212’s investment fees.

Buying stocks and ETFs is free with Trading 212. There is no commission when buying or selling stocks.

There are also no custody fees or inactivity fees. Maintaining your account is therefore also free. All deposits via bank transfer are also free.

However, if you buy a stock that is not in your base currency, you have to pay a conversion fee of 0.15%. And you have to pay the same fee when you sell the stock. These fees make currency conversions expensive with Trading 212. It’s not the worst rate, but not the cheapest either.

So, if you only buy stocks in your local currency, you pay no fees with Trading 212.

However, it’s worth knowing that commission-free transactions often come with hidden disadvantages. We will explore several of these downsides later.

Free Stock Trading

A noteworthy feature of Trading 212 Invest is the ability to trade stocks for free. This means investors can trade without adding extra costs to their transactions.

Robust Analytical Tools

Trading 212 Invest provides a suite of powerful analytical tools that investors can use to make informed decisions. From technical indicators to fundamental data, the platform caters to the needs of various types of investors.

Education Center

For investors looking to enhance their knowledge, Trading 212 offers a comprehensive education center. Here, users will find valuable information, tutorials, and educational materials to improve their investment skills.

Customer Service and Support

The customer service of Trading 212 is responsive and helpful. Users can reach out through various channels and can expect a prompt response.

Is Trading 212 Safe?

It’s important to examine how a broker is regulated and what would happen in the event of the broker’s bankruptcy.

As mentioned earlier, Trading 212 has multiple entities. If you’re a Swiss investor, you’re dealing with the Cypriot entity, not the UK entity.

It’s crucial to mention that the reputation of the Cypriot regulatory entity (CySEC) is quite alarming. It’s considered corrupt and willing to turn a blind eye to fraud. I have no evidence, but I prefer dealing with the UK-regulated entity in the UK.

As for asset protection, they should be safe. Interactive Brokers, one of the largest brokers, holds the stocks.

Additionally, 20,000 EUR is guaranteed by European regulation. Furthermore, Trading 212 has taken out insurance with Lloyd’s of London that protects its clients up to 1,000,000 EUR. This is a considerable insurance amount for a broker, significantly higher than any other brokers I know.

On paper, it seems that Trading 212 is safe for your assets. I wouldn’t necessarily rely on the 1 million euro guarantee, but it’s still good that they have this kind of insurance.

A significant issue is that you cannot transfer your stocks from your account to another broker. This inability to transfer is a red flag because reputable brokers handle this issue well. And it makes me worry that stocks are not managed properly by Trading 212 if they can’t transfer them.

Conclusion

Trading 212 Invest is an excellent platform for investors of all levels. With its user-friendly interface, wide range of investment opportunities, and cost-effective approach, it provides an attractive option for those seeking an easy to use investment partner.

Note: Investing carries risks and you can lose your capital. Always do your own research and consider your risk tolerance before investing.

Leave a comment